Fraud Prevention Center

According to the FBI's Internet Crime Complaint Center's (IC3) 2023 Internet Crime Report, the IC3 received 880,418 fraud complaints in 2023. From those complaints, the potential losses exceeded $12.5 billion. This is nearly a 10% increase in reviewed complaints and a 22% increase in losses suffered compared to 2022.

Whether it's protecting yourself from identity theft or fraud, NorState Federal Credit Union is here to provide tips, tools and resources to help keep your finances safe.

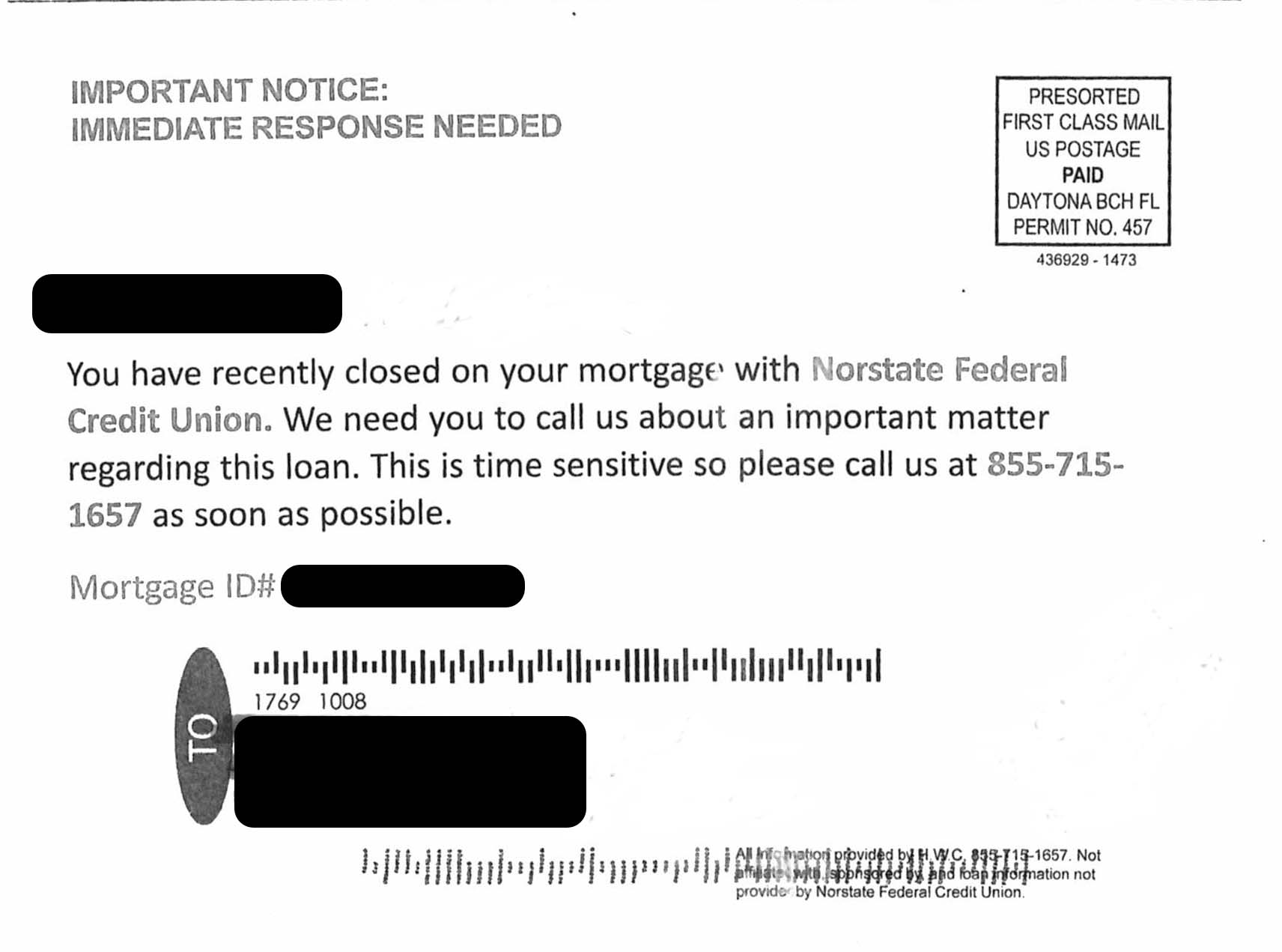

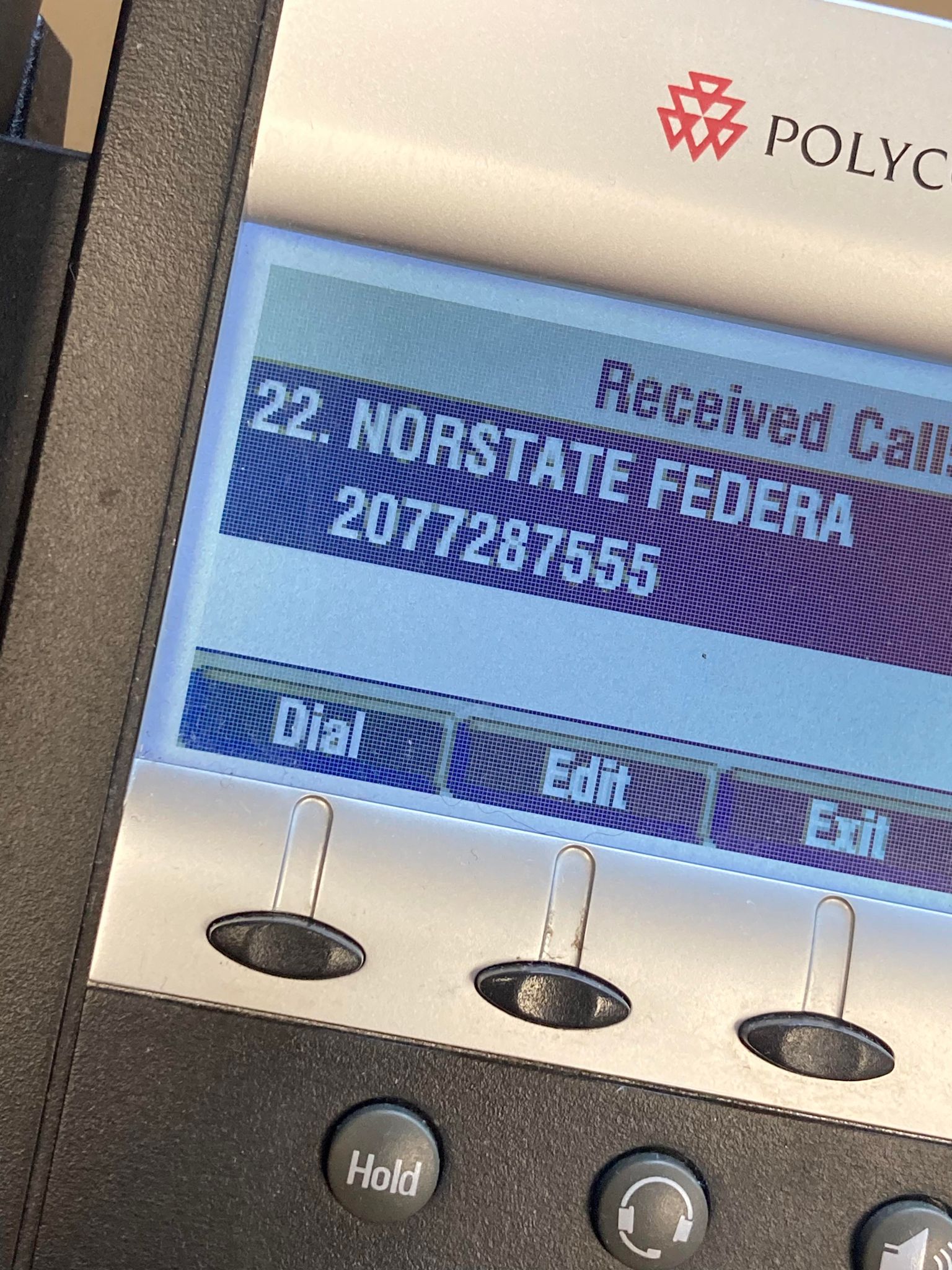

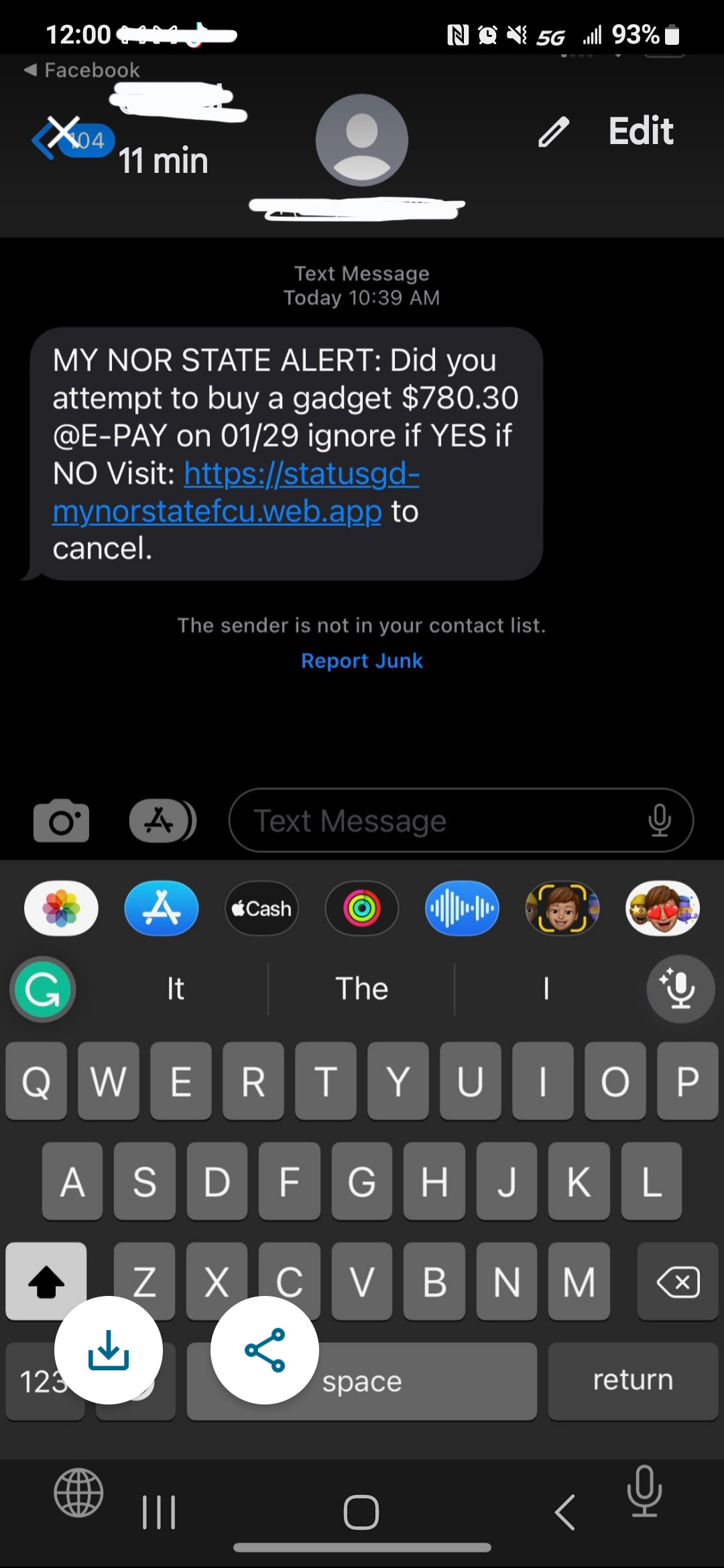

NorState Federal Credit Union will NEVER make unsolicited phone calls requesting your personal account information. If you ever receive mail, an email, text or phone call purporting to be from NorState FCU, do not provide any personal information. Always log into the NorState Federal Credit Union site directly (by typing www.norstatefcu.org in your browser address bar) or contact one of our Member Service Representatives before divulging any information. Pictured below are samples of a scam mailer, spoofed id caller and text message.

Protect Yourself. Don’t become identity theft’s next victim

There are simple precautions that will keep your identity safe. We've provided the following information as a courtesy to help protect you from identity theft and fraud. Review the links and information on this page to learn how to protect your personal and financial information.

If your identity has been stolen, here a few simple steps to take:

- Contact NorState Federal Credit Union for immediate assistance.

- Contact the fraud departments of any one of the three major credit bureaus to place a fraud alert on your credit file. The fraud alert requests creditors to contact you before opening any new accounts or making any changes to your existing accounts. As soon as the credit bureau confirms your fraud alert, the other two credit bureaus will be automatically notified to place fraud alerts, and all three credit reports will be sent to you at no cost.

- Credit Bureaus: Experian, Equifax and TransUnion

- Close or freeze the accounts that you know or believe have been tampered with or opened fraudulently.

- File a police report. Get a copy of the report to submit to your creditors and others that may require proof of the crime.

- File your complaint with the FTC. The FTC maintains a database of identity theft cases used by law enforcement agencies for investigations. Filing a complaint also helps us learn more about identity theft and the problems victims are having so that we can better assist you.

- If you believe you have been a victim of Mail Fraud, submit a mail fraud complaint form with the U.S. Postal Inspection Service.

Monitor Your Credit

Monitoring your credit has never been so easy. When you log into online or mobile banking, you'll have instant access to your credit score and credit report, along with personalized tips on how to improve or maintain your score. If you notice something unfamiliar on your credit report, it is important to notify one of the three credit bureaus right away to get the issue resolved.

Be Smart. Protect Yourself from Identity Theft

The following information is designed to safeguard your financial information.

- Credit Card Fraud Protection

- Identity Theft Protection

- Check Cashing Fraud Protection

- ATM Fraud Protection | ATM Scams

- Internet Security Tips

- Phone Security Tips

- Fraud Alerts & Credit Freezes

Here are some helpful resources provided by the Maine Credit Union League.

What to Remove from your Wallet

Online Security

Is there privacy on the Internet?

Technology now allows companies to collect information about you and possibly give that information to others. While the Internet is a tremendous resource for information, products and services, you should be sure to safeguard your privacy on-line by following these tips.

Keep Your Personal Information Private

Don't provide personal information - such as your date of birth, address, Social Security number or e-mail address, unless you know who's collecting the information, why they're collecting it and how they'll use it. If you have children, teach them to check with you before giving out any personal or family information online.

Look For a Company's Online Privacy Policy

Many companies post their privacy policy on their website. A company's privacy policy should disclose what information is being collected on the website and how that information is being used. Before you provide a company with personal information, check its privacy policy. If you can't find a policy, send an e-mail or written message to the website to ask about its policy and request that it be posted on the site.

Make Choices

Many companies give you a choice on their website as to whether and how your personal information is used. These companies give you the option to decline having personal information, such as your e-mail address, used or shared with other companies. Look for this as part of the company's privacy policy.

Safe Surfing on the Internet

Practical Advice from the FTC

The Federal Trade Commission provides some important points to keep in mind when you're using and exploring the World Wide Web.

Keep Private Information Private.

Don't disclose personal information unless you know who's collecting it, why, and how it's going to be used. And never disclose your password.

Get To Know Online Merchants.

Be cautious of a company that claims to have a "secret connection" overseas or doesn't allow e-mail replies.

Question Out-of-This-World Claims.

Claims like "you can earn over $50,000 a month" and "lose weight without dieting" suggest a scam. Be wary of any company that makes a product or performance claim that's unlikely or just plain hard to believe. If it sounds too good to be true, it most likely is.

Make Sure It's Secure.

If you buy something on the Internet and need to give your credit card number, verify the online security or encryption before you do business.

Know Who's Who.

Online, anyone can be anyone, anywhere. Because it's easy to fake e-mail addresses, be mindful of whom you're listening to or talking with before you give out personal information.

Be Careful About What Your Download

Watch those .exe files. Secret programs may exist in files you download, especially .exe files, which are executable files like mini-programs. These files could ruin your hard drive, hijack your modem, or collect information about you without your knowledge. Install a virus protection program before you go online.

Filter for Fun.

Inexpensive "filtering" software programs help make sure your family members are protected from sites that may not be age- or interest-appropriate.

Shopping Safely Online

The World Wide Web is an exciting tool that puts abundant information at your fingertips. With a click of the mouse, it lets you send flowers, buy airline tickets, book a vacation, and track or purchase stocks and mutual funds. This is great, but before you use what the Internet has to offer, be smart and make your online experience safe. Keep in mind the following tips to help ensure that your online shopping experience is a safe one:

- Use a secure browser. The browser that comes with your Internet access software should have industry-standard encryption.

- Shop with companies you know. If you're not familiar with one, ask for a paper catalog or brochure to get a better idea of their merchandise and services.

- Keep your password private. Never give it to anyone. Avoid using a telephone number, birth date, or a portion of your Social Security number. Instead, use a combination of numbers, letters, and symbols.

- Pay by credit or charge card. Your transaction will be protected by the Fair Credit Billing Act, under which you have the right to dispute charges under certain circumstances and temporarily withhold payment while the creditor is investigating them.

- Keep a record. Be sure to print a copy of your purchase order and confirmation number for your records.

- Beware of offers made on websites. These are not considered to be genuine offers in writing and are not binding. The reason for this is that websites can be easily changed. An offer appearing one day may be gone the next, and you cannot prove what an offer was when you first saw it.

- Be forewarned - If you see an offer you're interested in, get the specifics in writing before taking advantage of it.

Think Privacy & Security When exploring online, remember the privacy and security questions you should ask about a company:

- What information does the company collect about me and is it secure?

- How does it use that information and what is the benefit to me?

- What choices do I have about its use of information about me?

If you have been the victim of identity theft or fraud here's how to file a complaint:

-

You can file a complaint with the FTC by contacting the Consumer Response Center:

- Telephone: (877)-FTC-HELP (877-382-4357)

- Mail: Consumer Response Center, Federal Trade Commission, 600 Pennsylvania Avenue NW, Washington, DC 20580

- Internet: online complaint form found at www.ftc.gov